As the 2024 Budget draws nearer, the media has been busy speculating about what the Chancellor of the Exchequer, Jeremy Hunt, could have in store. With a General Election pencilled in for later this year, it’s likely Mr Hunt will do his best to attract voters with some announcements that protects their hard-earned cash.

According to the BBC, Mr Hunt has come under growing pressure from Tories to lower taxes, which are currently at a historic high. While the Chancellor has hinted that he will introduce tax cuts, he has also stressed it would only be done in a ‘responsible way’.

With this in mind, read on to discover some of the tax changes Mr Hunt might be thinking of announcing on 6 March, according to the media. Before you do though, let’s consider the UK’s economy and how it could affect the Chancellor’s thinking.

While Britain has fallen into a recession, it may only be a brief one

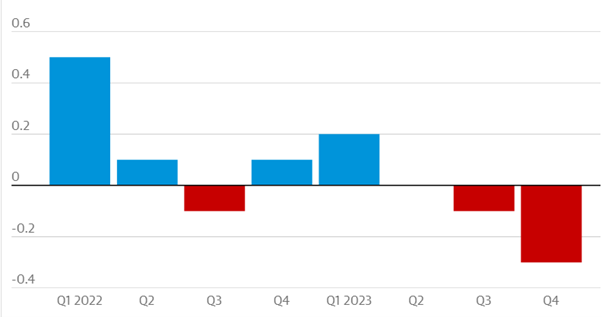

Growing the economy was one of Rishi Sunak’s key pledges when he became Prime Minister. Yet in February, the Office for National Statistics revealed that the UK’s gross domestic product figures (GDP) dropped 0.3% in Q4 of 2023. The GDP measures the economic health of a country.

The decline in Q4 followed a drop of 0.1% in the third quarter, making it the second consecutive drop. As such, the UK is technically in a recession.

The Bank of England may cut its interest rates as inflationary pressures cool and this could boost consumer confidence and kickstart the economy. Despite this, there are still challenges for the Chancellor. For example, weaker public finances because of higher interest costs on government borrowing might limit Mr Hunt’s options. So, with this in mind, we’ll now consider the tax-cuts that might be announced.

A further cut in National Insurance Contributions

In his Autumn Statement of 2023, the Mr Hunt announced that Class 2 National Insurance Contributions (NICs) for the self-employed would be abolished. In addition to this, Class 4 NICs will drop from 9% to 8% for self-employed people earning between £12,570 and £50,270.

Both of the changes come into force as from April 2024. Mr Hunt also reduced the main class of NICs for employed people from 12% to 10% for basic-rate taxpayers, something that came into effect at the start of 2024.

Yet the BBC has suggested that he may be considering a further cut to NICs as this could help ease the tax burden for those who are working. According to the BBC it’s more likely that he’ll do this than reduce Income Tax.

Scrapping the non-dom tax status

While possible tax cuts make for good headlines, a report by The Times makes for more sobering reading. It revealed that Mr Hunt may also consider increasing some taxes to help fund further cuts to NICs.

According to media pundits, this could include scrapping the tax benefits enjoyed by those living in the UK with non-domiciled status. Under the current system, they do not pay UK tax on money that they make overseas.

Yet this may be scrapped in order to fund any further reduction to NICs. Furthermore, The Times suggests the Chancellor may remove tax breaks given to owners of second homes, that they rent out to holidaymakers.

Increase to Income Tax thresholds

According to FTAdviser, the chancellor may increase Income Tax allowance as well as the threshold for the higher rate band. The Personal Allowance is the amount you’re allowed to earn before Income Tax is charged and the higher rate band threshold is the point at which you become liable to 40% higher-rate tax.

In 2022, Mr Hunt froze the allowance at £12,570 and the threshold at £50,270 until April 2028. As such, the Chancellor might use the Budget to try to ease the tax burden the freeze has created for millions of Britons.

While there has been rumours that Mr Hunt might reduce the basic rate band threshold, pundits are doubtful this will happen – even with a General Election looming.

Rise in the Inheritance Tax nil-rate band

A decision to abolish or reduce Inheritance Tax (IHT) is being seen as unlikely, yet Sky News revealed that the Chancellor could change thresholds to account for rising house prices. Currently the thresholds, which are otherwise known as the nil-rate band (NRB), are between £325,000 and £1 million, depending on your circumstances.

The thresholds have been frozen until April 2028. Changing the NRB could help to reduce millions of British households’ exposure to the tax, which is typically charged at 40%. Sky News also revealed that the Chancellor could also be considering tweaking the 40% rate of IHT, or changing the rules on making gifts to reduce exposure to the tax.

Reduction of Stamp Duty Land Tax

The slower housing market could prompt the Chancellor to look at reducing Stamp Duty Land Tax (SDLT). According to Mortgage Strategy, cutting SDLT could unleash ‘growth friendly tax cuts’ and help younger people who want to buy a property.

This in turn could provide the property market and the UK economy a shot in the arm. That said, little has been reported in the media about any plans Mr Hunt may have to do this, so it’s fair to say that it’s looking unlikely.

Get in touch

If you would like to understand how any changes announced in the 2024 Budget affects you, please contact us as we’d be pleased to help. You can speak to one of our advisers or call us on 01527 577775.

Monday 4 March 2024 | 5:15pm