According to The Guardian in October, the UK economy may be showing the first signs of recovery. It explains that experts are suggesting the economy could be showing signs of improvement after growing by 0.1% in August.

While the growth, which was driven by a strong performance by the manufacturing and health sectors, will be welcomed, it wasn’t all good news. The article added that the growth may be ‘sluggish’ as businesses and consumers wait to see what’s announced in November’s Budget.

Alongside this, there’s the Office for National Statistics decision to revise July’s flatline economic growth to a 0.1% contraction. With all these mixed messages and uncertainty, you might be wondering what it all means for the stock market and any investments that you might have.

If you are, there could be good news: the stock market doesn’t always reflect the performance of the economy, meaning your investments may perform better than you think during a lacklustre economy. Read on to discover more.

The stock market and economy sometimes move in different directions

Broadly speaking, the stock market is where investors can buy and sell shares of publicly traded companies. Each market has an index that tracks the performance of companies registered on it.

The best-known UK index is probably the FTSE 100, which tracks the performance of the largest 100 qualifying UK companies. The economy, on the other hand, represents how money is being made and spent by a country’s citizens, companies, and governments.

Economic indicators like Gross Domestic Product (GPD), which is the total monetary value of all goods and services produced, can influence stock market performance.There isn’t a direct correlation between the two and the relationship between them is influenced by several different factors.

For example, the stock market is forward-looking and based on future expectations, while the economy is based on past performance and data.

Consequently, there are times when the economy and stock market can respond to events and announcements in very different ways.

The stock market is usually driven by investor expectation

When these events and announcements hit the headlines, the way the stock market reacts is often driven by investors’ perception. In other words, whether investors feel the event or announcement is better or worse than was expected.

So for example, if an announcement about the economy is bad news, but not as bad as expected, the markets may rally and share prices rise. If the announcement is good news, but not as good as hoped for, the stock market may become volatile and equity prices could drop.

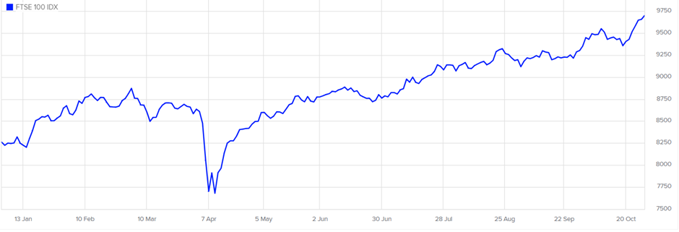

Interestingly, an example of a stock market index performing well despite poor economic performance is the FTSE 100 between 1 January and 28 October 2025. As you can see from the illustration below, even with significant downturns along the way, the index increased during the period despite the UK economy performing relatively poorly.

Source: London Stock Market

Beware of ‘knee jerk’ decisions when economies are performing poorly

When the headlines are full of doom and gloom about the UK or global economy, it’s understandable to feel concerned. Becoming too concerned, however, could result in you selling your investments to limit potential losses, which might be a decision you later regret.

Selling your investments has the potential to turn a paper loss into a real one and deprive your money of any chance of recovery when the stock market recovers – which historically, it’s tended to do.

In addition to this, your money will miss out on any future growth potential as the markets continue to rise. This is why it’s often better to try to remain calm when the economy is struggling and concentrate instead on your long-term investment goals.

Always remember that past performance of investments is no guarantee of future performance, and you may get back less than you originally invested. If you are considering selling your investments, always speak to a financial adviser first. They can confirm whether disposing of your investments is the right thing for you and explain the pros and cons involved with selling or staying invested.

Get in touch

As one of the UK’s largest independent financial advice companies, we can explain what the current economic climate and what it might mean for your investments.

We’ll use jargon-free language to help you make better decision with your investments, so that you can achieve your goals more quickly. If you would like to discuss this further, call us on 0333 010 0008 and we’d be happy to arrange a no obligation initial meeting with one of our Independent Financial Advisers.

5 November 2025