Early in 2025 Donald Trump unveiled his global tariffs, which created world-wide economic upset. With the ongoing conflicts in Ukraine and the Middle East, 2025 has been something of a roller coaster ride when it comes to the global economy, although broadly speaking the stock market weathered the storm.

At home inflation increased in April, rising to 3.5% from 2.6% the month before. In the second half of the year, inflation refused to drop by any significant amount, which meant the Bank of England (BoE) reduced interest rates more slowly than many had hoped.

All in all, 2025 has been an eventful year with plenty of economic twists and turns. So, as we approach the end of the year, let’s look at five key events that could have affected you if you hold investments.

Please remember that if your portfolio holds global equities, the following events may not have impacted their performance

1. Trump tariffs

In April, Donald Trump announced tariffs on goods being imported into America, arguing they would help to boost manufacturing in the US and create jobs. When they were announced, China faced tariffs of up to 54%, although this soared to 130% later on.

Small surprise that these so-called ‘Liberation Day’ tariffs spooked global trading and led forecasters to slash their projections for global economic growth. It also sent shockwaves through the financial markets, although this eased when the President later reduced tariffs on some countries, which included China.

In August, British Prime Minister Keir Starmer negotiated a 10% tariff for the auto industry, reducing it from 27.5%. Furthermore, the PM agreed tariffs for certain elements of the aerospace sector were removed completely, something the Government claimed would safeguard key industries and the UK economy.

That said, in November Business Matters revealed that trade between the UK and the US had dropped. According to data from the Office for National Statistics (ONS), UK exports to America fell by 11.4% month on month in September, taking it to the lowest level since January 2022.

It wasn’t all doom and gloom though. In October The Guardian revealed findings by the International Monetary Fund (IMF), which found that the global economy had demonstrated ‘unexpected resilience’ to the tariffs.

However, it also warned that the full impact of Trump’s tariffs may not have been felt, meaning the outlook for economic growth remained ‘dim’.

2. Interest rates

Millions of households got some welcome news just before Christmas when the Bank of England (BoE) cut its interest rates from 4% to 3.75%. The central bank had already dropped its base interest rate during 2025, cutting it from 4.5% to 4.25% in May, and then again to 4% in August.

According to the Guardian, the drop to 3.75% was because the BoE expects inflation to drop in 2026. The prediction looked like it could become a reality when the ONS revealed inflation stood at 3.2% November, down from 3.6% the month before.

In July, August and September it remained at 3.8%, nearly double the BoE’s target inflation rate of 2%. While millions of homeowners will welcome the news as it could reduce their monthly repayments, the drop may not be quite so good for savers, who could see a fall in the amount of interest they earn.

3. Jaguar Land Rover cyber-attack

In September, Jaguar Land Rover (JLR) stopped production for several weeks following a major cyber-attack. The estimated cost of the cyber-attack on JLR was reported to be £1.9 billion, making it the costliest in UK history according to researchers.

However, the halt in production could have had a significant impact on the UK economy, media reports suggest. According to articles, data from the ONS revealed that UK economic growth shrunk from an expected 0.3% to just 0.1% in the three months to October.

A key reason for this was a reduction in car production.

4. The 2025 Budget

Weeks of media speculation and a leaked report by the Office for Budget Responsibility (OBR) meant that nothing that was announced on the day came as a surprise. Policies such as the freezing the Income Tax threshold until 2031, and the pay-per-mile levy on electric vehicles, had been reported by the media long before the Budget on 26 November.

In the wake of this, a Treasury committee enquiry was established to investigate how the media had been briefed and the OBR’s Chairman, Richard Hughes, resigned as a result of the leak.

Some of the announcements made by the Chancellor on the day included:

- increased Income Tax rates on property, savings and dividends

- a reduced Cash ISA allowance from April 2027 for under 65s

- a limit on the National Insurance Contributions relief on Salary Sacrifice schemes, otherwise known as Salary Exchange schemes, after April 2029

- introduction of the High Value Council Tax surcharge, otherwise known as the ‘Mansion Tax’

- an increase in that basic- and higher- rate of Dividend Tax from April 2026.

In the wake of the announcements, financial experts warned that millions of people could see a significant increase in their exposure to tax. If you’re likely to be one of them, speaking to a financial adviser or tax professional could help to ensure your wealth is as tax-efficient as possible.

Stock market performance

While it would be fair to say the markets have been volatile in 2025, there is good news for some investors as, broadly speaking, global equities provided a strong performance. One reason for the markets’ performance was the continued enthusiasm for AI, which helped several of the larger tech stocks.

The ongoing conflicts around the globe probably buoyed the performance of the aerospace and defence industries, as several governments committed to increase future spending on defence. As a result, many investors have enjoyed strong returns during 2025 despite the challenging economic environment.

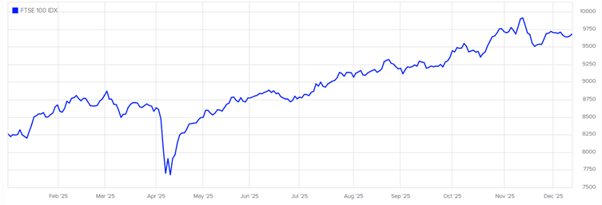

To illustrate this, you may want to consider the following illustration of the FTSE 100 between 2 January 2025 and 11 December 2025. The UK based index tracks the performance of the largest 100 companies registered on the London Stock Exchange.

Source: London Stock Exchange

As you can see, despite downturns along the way, the index has continued to increase in value during the period. As already alluded to above, the FTSE 100 does not represent the performance of a globally invested portfolio.

Always remember that past performance is no guarantee of future performance, and you may receive back less than you originally invested.

Get in touch

If you would like to discuss any of the above events and how they may affect your wealth, please contact us on 0333 010 0008 and we’d be happy to arrange a no-obligation initial meeting with one of our independent financial advisers.

5 January 2026