5 top tips when spring cleaning your finances to ensure they’re ship shape

You might know where to start with de-cluttering your home, but if you’re wondering how to spring clean your finances, read our latest blog to discover five top tips.

You might know where to start with de-cluttering your home, but if you’re wondering how to spring clean your finances, read our latest blog to discover five top tips.

While investing at the end of the tax year means you can use your allowance and place a substantial amount of money into your ISA, waiting until March could actually be detrimental to your wealth. As the allowance, which is £20,000 in 2024/25, cannot be rolled over to the next tax year, if you don’t use it before the start of the new tax year on 6 April, you lose it.

Compounding is growth you make on growth you’ve already made When you invest your money you’re exposing it to growth potential. This could be accelerated with compounding, as any growth your money enjoys is then exposed to further growth potential in the future.

In this month’s commentary our Chief Economist, Colin Warren, assesses the prospects for Japanese equities in light of recent policy changes from the Bank of Japan.

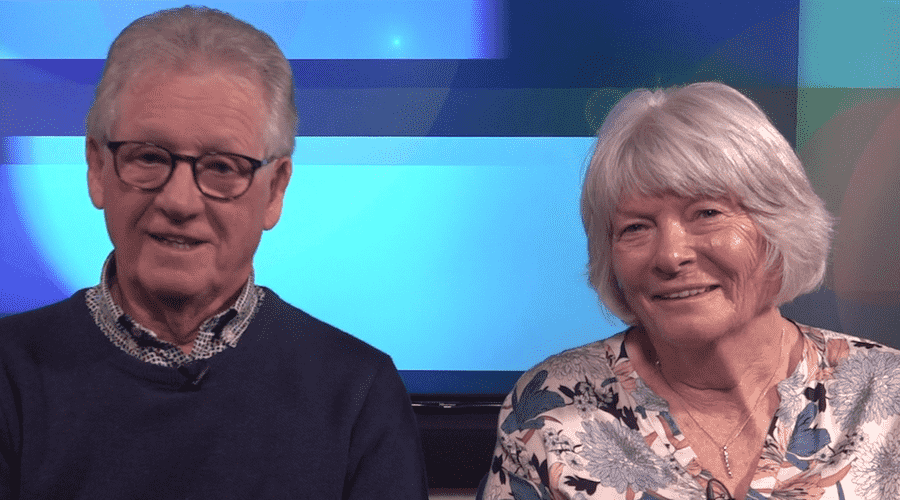

We were privileged to invite two of our clients, Peter and Mary Lightfoot, into Head Office recently to tell us about their experiences with AFH.

On April 5, the 2023/24 tax year comes to an end. While that may feel like a little way off, it’s likely to come around very quickly and if you haven’t made the most of the tax-benefits available to you, it may soon be too late.

Today marks International Women’s Day, which celebrates gender equality, diversity and the achievements of females across the globe. This is something that’s close to our heart at AFH Wealth Management.

With speculation growing about the timing of the 2024 general election, many wondered what the Chancellor, Jeremy Hunt, would announce in his Budget to win voters over. To find out what was said in today’s spring budget (Wednesday 6 March 2024), read our quick roundup.

As the 2024 Budget draws nearer, the media has been busy speculating about what the Chancellor of the Exchequer, Jeremy Hunt, could have in store. With a General Election pencilled in for later this year, it’s likely Mr Hunt will do his best to attract voters with some announcements that protects their hard-earned cash. With this in mind, read on to discover some of the tax changes Mr Hunt might be thinking of announcing on 6 March, according to the media.